Best High Interest Savings Accounts UK | BudgetSense.co.uk

Visual summary of key points from 'Best High Interest Savings Accounts UK | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

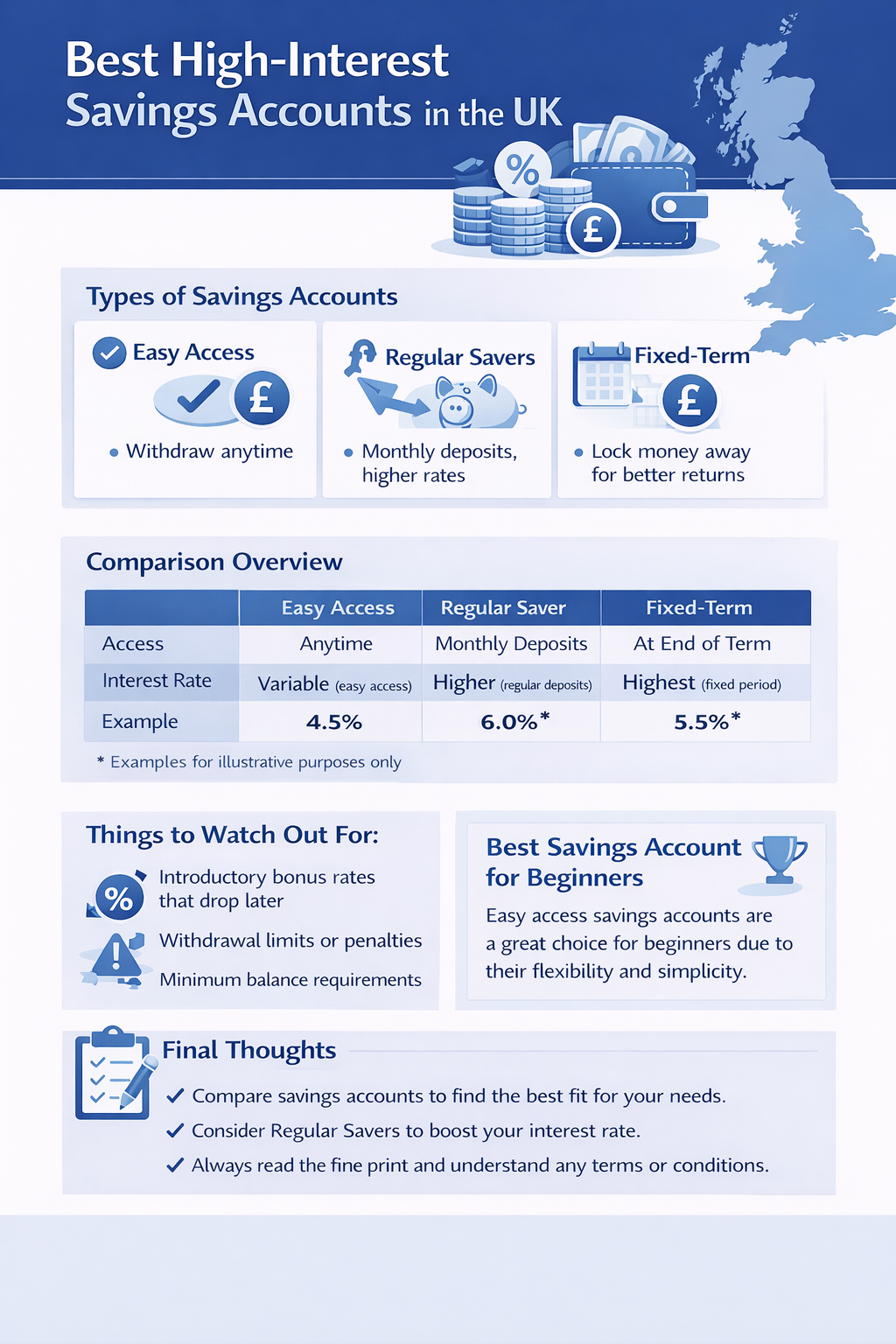

Best High-Interest Savings Accounts in the UK

With interest rates changing regularly, choosing the right savings account can make a noticeable difference — even on modest balances.

This guide explains the main types of high-interest savings accounts in the UK and how to choose one that suits your goals.

Types of Savings Accounts

- Easy access: Withdraw anytime

- Regular savers: Monthly deposits, higher rates

- Fixed-term: Lock money away for better returns

Comparison Overview

| Account Type | Access | Typical Interest | Best For |

|---|---|---|---|

| Easy Access | Instant | Lower | Emergency funds |

| Regular Saver | Monthly limits | Higher | Consistent saving |

| Fixed-Rate | Locked | Highest | Long-term goals |

Best Savings Account for Beginners

If you’re new to saving, an easy-access savings account is usually the safest place to start. It keeps money accessible while earning interest.

Affiliate placeholder:

👉 View top easy-access savings accounts (affiliate link)

Things to Watch Out For

- Introductory bonus rates that drop later

- Withdrawal limits or penalties

- Minimum balance requirements

Final Thoughts

The “best” savings account depends on how often you need access to your money. A slightly lower rate is often worth it for flexibility and peace of mind.