How To Create A Simple Budget That Actually Works UK

Visual summary of key points from 'How To Create A Simple Budget That Actually Works UK'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

How to Create a Simple Budget That Actually Works (UK Guide)

If budgeting has ever felt like punishment rather than progress, you’re not doing anything wrong. Most UK budgeting advice is far too complicated for real life.

This guide focuses on building a simple, flexible budget you can actually stick to — even when costs rise or motivation dips.

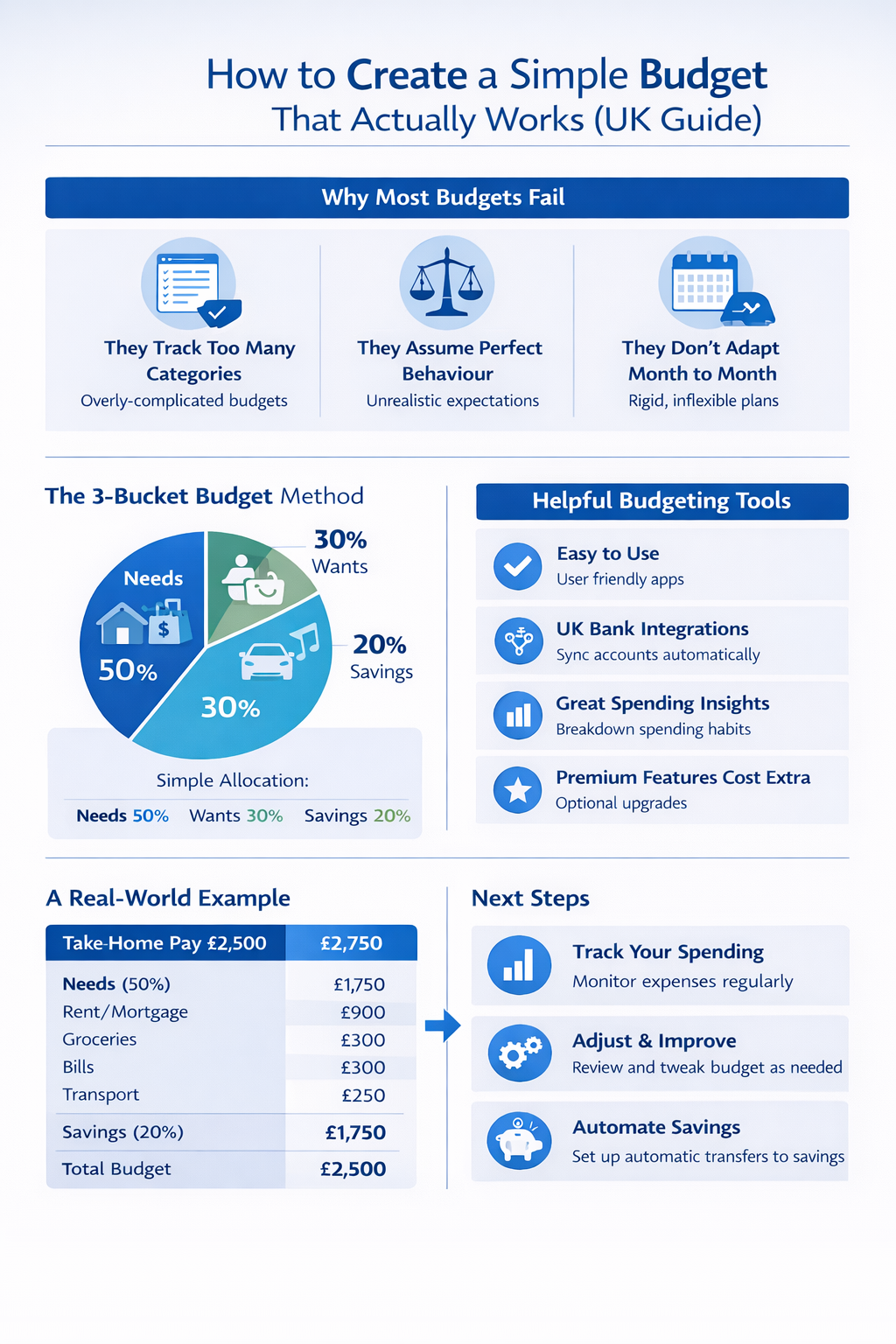

Why Most Budgets Fail

- They track too many categories

- They assume perfect behaviour

- They don’t adapt month to month

A good budget should quietly guide decisions, not dominate your life.

The 3-Bucket Budget Method

| Bucket | What It Covers | Target % |

|---|---|---|

| Essentials | Rent, council tax, utilities, food, transport | 50–60% |

| Lifestyle | Eating out, subscriptions, hobbies | 20–30% |

| Future | Savings, debt overpayments | 10–20% |

Helpful Budgeting Tools

Emma

- Easy to use

- UK bank integrations

- Great spending insights

Limitations

- Premium features cost extra

A Real-World Example

A UK couple earning £3,200 per month reduced overdraft use by £400 in two months simply by reviewing spending once a week and sticking to broad categories.

Next Steps

If you want help automating this, see our guide to the best budgeting apps in the UK.