How Credit Scores Work UK | BudgetSense.co.uk

Affiliate Disclosure:

This article contains affiliate links. If you click and make a purchase, we may earn a small commission at no extra cost to you.

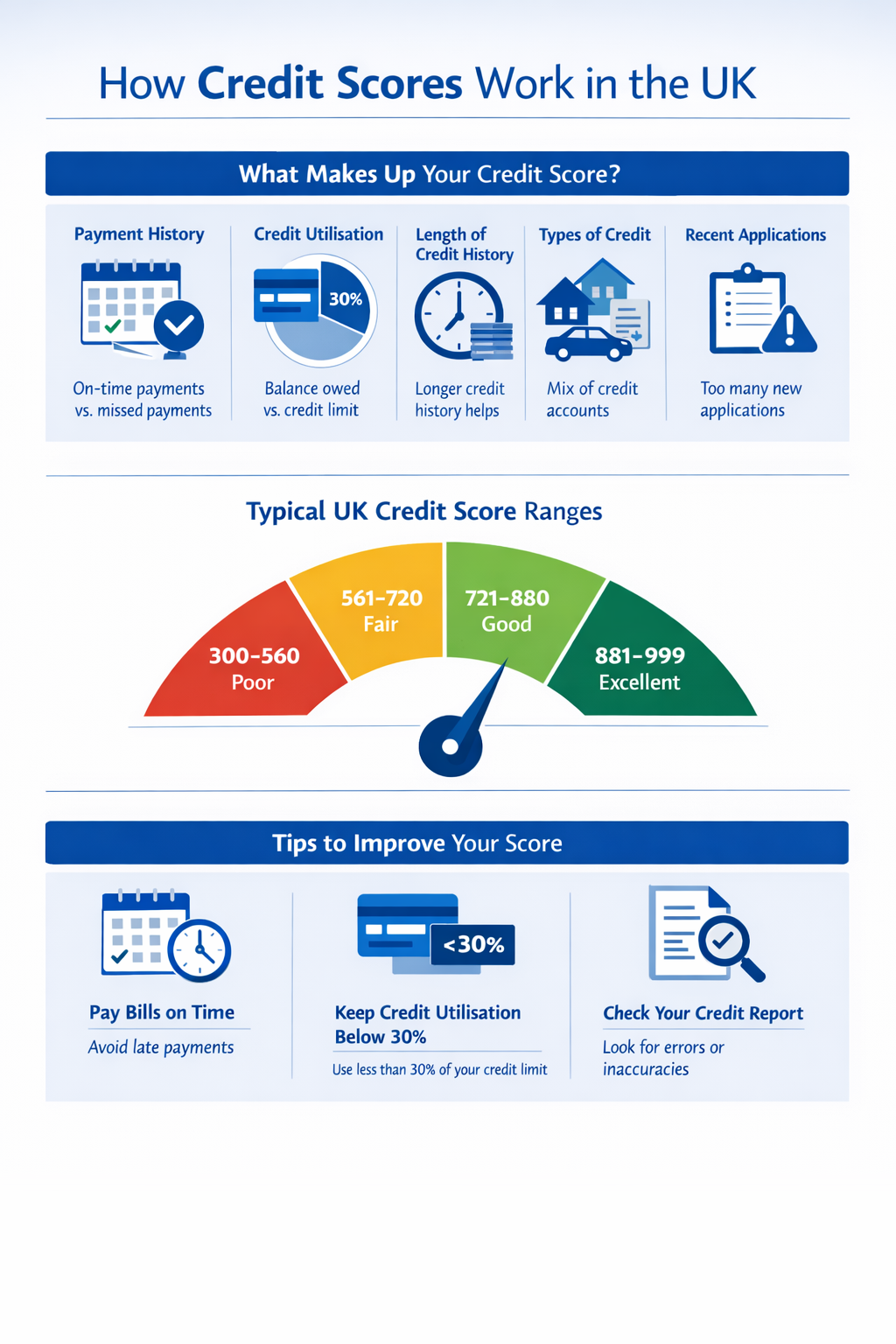

Visual summary of key points from 'How Credit Scores Work UK | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

How Credit Scores Work in the UK

Your credit score can affect whether you get approved for loans, credit cards, or even rental agreements. Understanding how it works is the first step to managing it effectively.

What Makes Up Your Credit Score?

- Payment history: Timely payments boost your score; missed payments lower it.

- Credit utilisation: Keep credit card balances low relative to limits.

- Length of credit history: Older accounts help your score.

- Types of credit: A mix of credit types is favourable.

- Recent applications: Many new applications in a short period can reduce your score.

Typical UK Credit Score Ranges

| Score Range | Rating | Impact |

|---|---|---|

| 0–560 | Poor | Harder to get credit, higher interest rates |

| 561–720 | Fair | May get credit, some higher interest |

| 721–880 | Good | Generally approved, lower interest rates |

| 881–999 | Excellent | Easy approval, best rates |

Tips to Improve Your Score

- Pay bills on time

- Keep credit utilisation below 30%

- Check your credit report for errors

- Avoid multiple credit applications in a short period

- Keep older accounts open

Understanding your credit score empowers you to make better financial decisions and secure credit when you need it.