Debt Snowball vs Debt Avalanche: Which Works Best? | BudgetSense.co.uk

Visual summary of key points from 'Debt Snowball vs Debt Avalanche: Which Works Best? | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

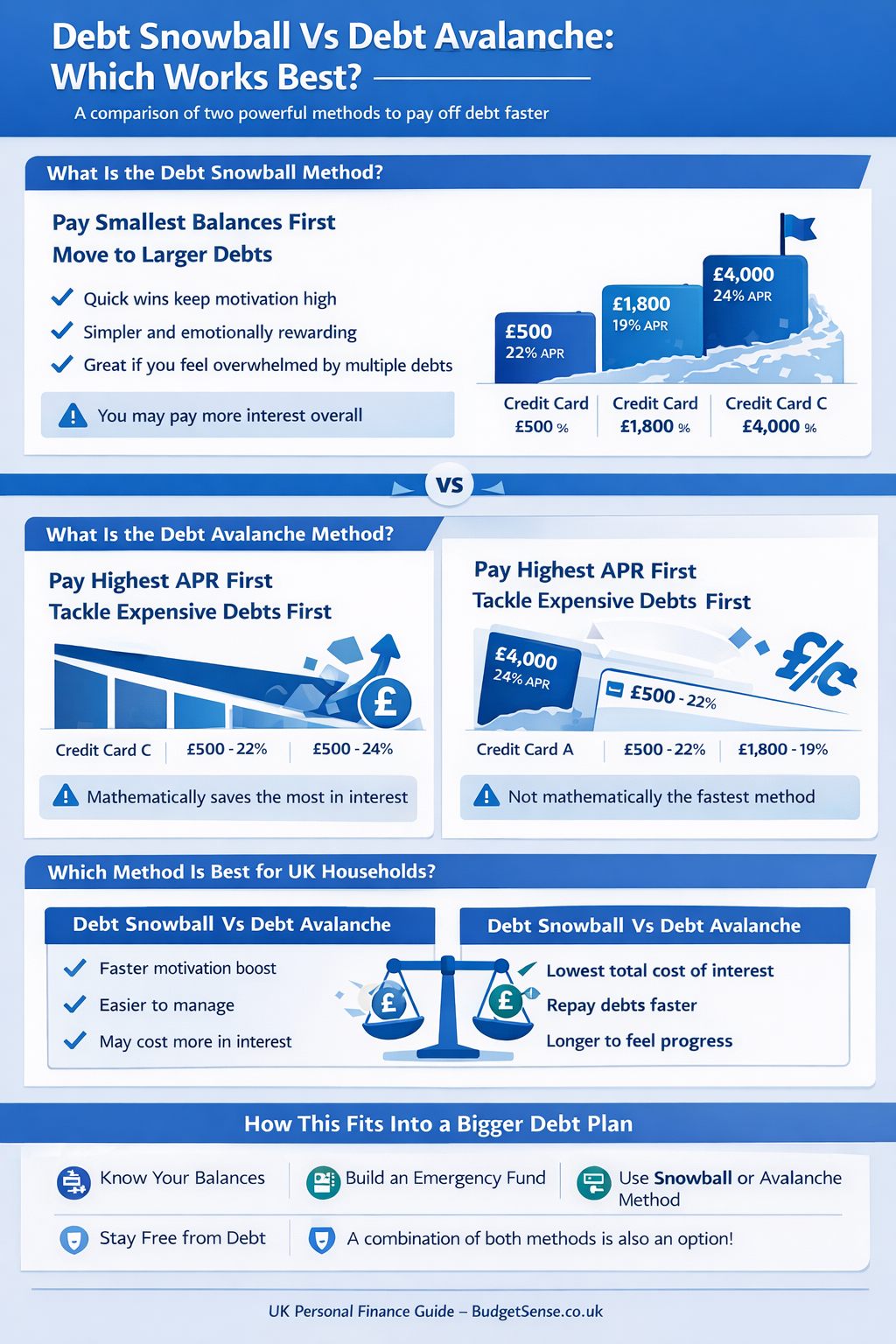

Debt Snowball vs Debt Avalanche: Which Works Best?

If you’re trying to pay off debt UK households commonly struggle with, choosing the right repayment strategy can make a huge difference. Two of the most popular methods are the debt snowball and the debt avalanche. Both work—but they work differently, and the best option depends on your personality, finances, and motivation.

What Is the Debt Snowball Method?

The debt snowball method focuses on paying off your smallest debt first, regardless of interest rate. You make minimum payments on all other debts and throw any extra money at the smallest balance.

Once that debt is cleared, you roll its payment into the next smallest debt—creating momentum, like a snowball rolling downhill.

Example:

- Credit Card A: £500 balance, 22% APR

- Credit Card B: £1,800 balance, 19% APR

- Credit Card C: £4,000 balance, 24% APR

You would pay off Credit Card A first, even though it doesn’t have the highest interest rate.

Pros of the Debt Snowball

- Quick wins keep motivation high

- Simpler and emotionally rewarding

- Great if you feel overwhelmed by multiple debts

Cons of the Debt Snowball

- You may pay more interest overall

- Not mathematically the fastest method

What Is the Debt Avalanche Method?

The debt avalanche method prioritises debts with the highest interest rate first, regardless of balance size. You still make minimum payments on all debts but direct extra money to the most expensive debt.

This approach is mathematically the most efficient way to pay off debt UK households owe on credit cards.

Using the same example:

- Credit Card C (24% APR) would be paid off first

Pros of the Debt Avalanche

- Saves the most money on interest

- Faster overall debt reduction

- Best for high-interest credit card debt

Cons of the Debt Avalanche

- Slower initial progress can feel discouraging

- Requires patience and discipline

Debt Snowball vs Debt Avalanche: Key Differences

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Focus | Smallest balance first | Highest interest first |

| Motivation | Very high | Moderate |

| Interest saved | Lower | Highest |

| Best for | Behaviour change | Cost efficiency |

Which Method Is Best for UK Households?

The best method is the one you’ll stick to.

Choose the debt snowball if:

- You feel stressed or demotivated by debt

- You need fast psychological wins

- You’ve struggled to stick to repayment plans before

Choose the debt avalanche if:

- You want to minimise interest costs

- You’re comfortable with slower early progress

- You’re tackling high-interest credit card debt

Both methods can be combined with balance transfers or budgeting changes for even faster debt reduction UK results.

How This Fits Into a Bigger Debt Plan

Whichever method you choose, it works best as part of a wider plan that includes:

- Reducing expenses

- Increasing income where possible

- Avoiding new credit card usage

For a full step-by-step approach, read our pillar guide: How to Pay Off Credit Card Debt Faster UK

Conclusion: Snowball or Avalanche?

The debate between debt snowball vs debt avalanche isn’t about right or wrong—it’s about what works for you. If motivation keeps you moving, the snowball wins. If saving interest is your priority, the avalanche comes out on top.

Take action today: choose one method, commit to it, and make your next payment more than the minimum. Consistency—not perfection—is what gets you debt-free.