Best Debt Consolidation Options UK | BudgetSense.co.uk

Visual summary of key points from 'Best Debt Consolidation Options UK | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

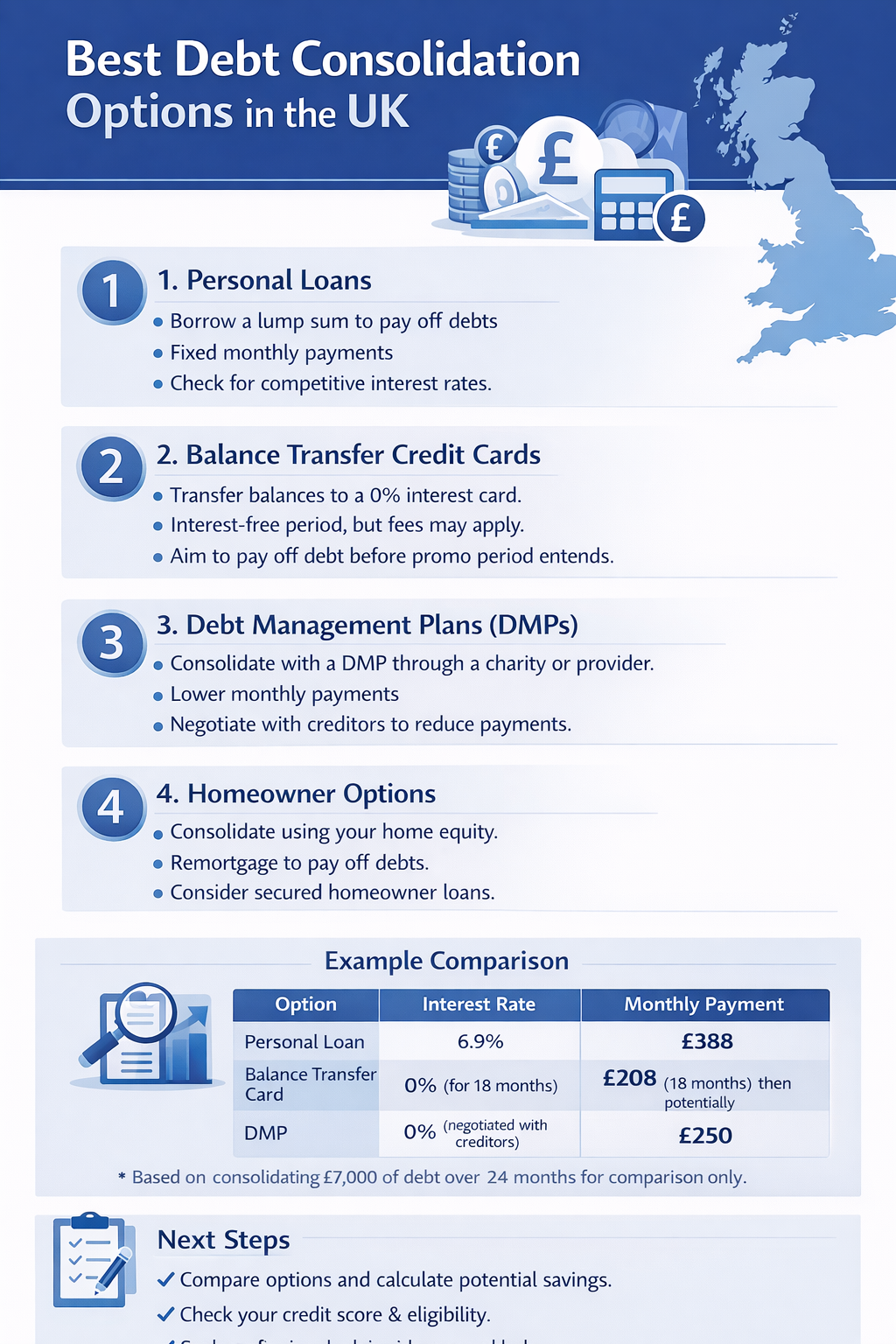

Best Debt Consolidation Options in the UK

If you’re juggling multiple debts, consolidation can simplify repayments, reduce interest costs, and help you stay on track. In the UK, there are several reliable options for consumers, depending on your financial situation, credit score, and whether you own a home.

1. Personal Loans

Personal loans allow you to pay off multiple smaller debts with one monthly payment. They can often offer lower interest rates than credit cards if you have a good credit score.

- Typical UK APR: 6–15% (depending on credit score)

- Repayment term: 12–60 months

- Benefits: Fixed monthly payments, simpler budgeting

- Considerations: Good credit usually required; may include arrangement fees

2. Balance Transfer Credit Cards

These cards offer a 0% interest period for a fixed number of months, allowing you to move high-interest debt onto one card.

- 0% interest period: 12–30 months

- Balance transfer fee: 0–3%

- Pros: Can save hundreds in interest if paid off during the promotional period

- Cons: High-interest rates after promo period; requires disciplined repayment

3. Debt Management Plans (DMPs)

Arranged through a UK debt charity (e.g., StepChange, National Debtline), a DMP consolidates your monthly repayments to creditors.

- Monthly payment based on affordability

- Interest and charges may be frozen or reduced

- Pros: Professional guidance, single payment

- Cons: Can impact credit rating; not legally binding on creditors

4. Homeowner Options

If you own your home, you may consolidate debt via remortgaging or taking a secured loan. These can offer lower interest rates, but your home acts as collateral.

- Typical APR: 3–6%

- Pros: Lower rates, potential tax benefits

- Cons: Risk of repossession if payments missed; may increase mortgage term

Comparison Table

| Option | Typical UK Rates | Pros | Cons |

|---|---|---|---|

| Personal Loan | 6–15% APR | Fixed payments, simpler budgeting | Good credit required, fees possible |

| Balance Transfer Card | 0% promo (then 18–25%) | Save interest if repaid on time | High post-promo APR, discipline needed |

| Debt Management Plan | N/A | Charity support, single monthly payment | Credit rating impact, not legally binding |

| Secured Loan / Remortgage | 3–6% APR | Lower interest rates | Home at risk if missed payments |

Tips for Choosing the Right Option

- Check your credit score before applying.

- Compare APR and fees for personal loans and credit cards.

- Consider speaking to a regulated debt adviser if unsure.

- Do not consolidate using another high-interest product — it defeats the purpose.

Next Steps

Start by reviewing your debts carefully, then select the option that suits your risk profile and financial goals. Use our budgeting calculator to plan repayments.