How To Get Out Of Debt UK | BudgetSense.co.uk

Affiliate Disclosure:

This article contains affiliate links. If you click and make a purchase, we may earn a small commission at no extra cost to you.

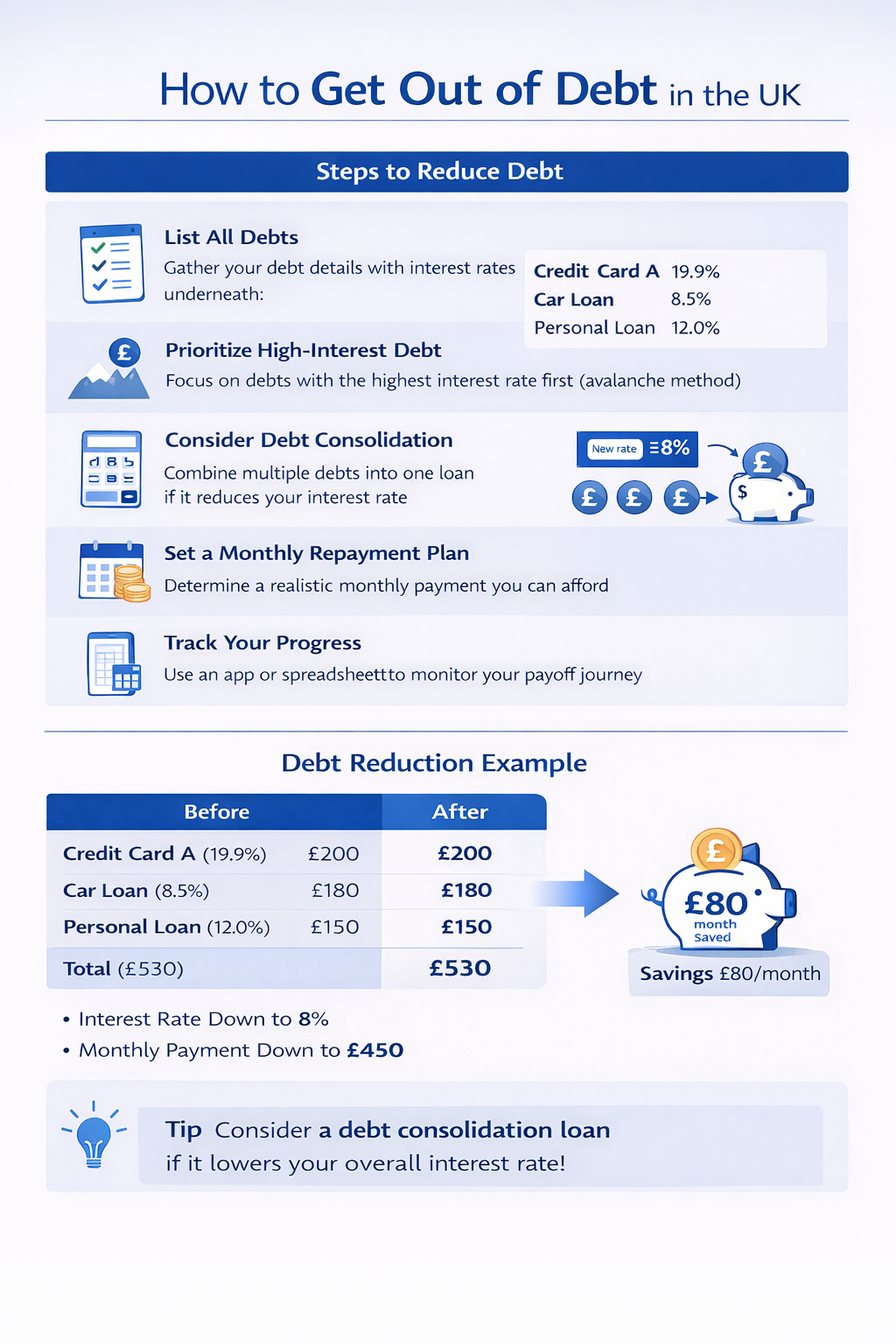

Visual summary of key points from 'How To Get Out Of Debt UK | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

How to Get Out of Debt in the UK

Debt can feel overwhelming, but with a structured approach, you can regain control.

Steps to Reduce Debt

- List all debts with interest rates

- Prioritize high-interest debt first (avalanche method)

- Consider a debt consolidation loan if feasible

- Set a realistic monthly repayment plan

- Track progress using an app or spreadsheet

Debt Reduction Example

| Debt | Balance (£) | Interest (%) | Monthly Payment (£) |

|---|---|---|---|

| Credit Card | £2,500 | 19.9 | £150 |

| Personal Loan | £5,000 | 9.5 | £200 |

| Store Card | £600 | 25.9 | £50 |

Tip

Even small extra payments accelerate debt freedom.