How To Improve Your UK Credit Score Quickly

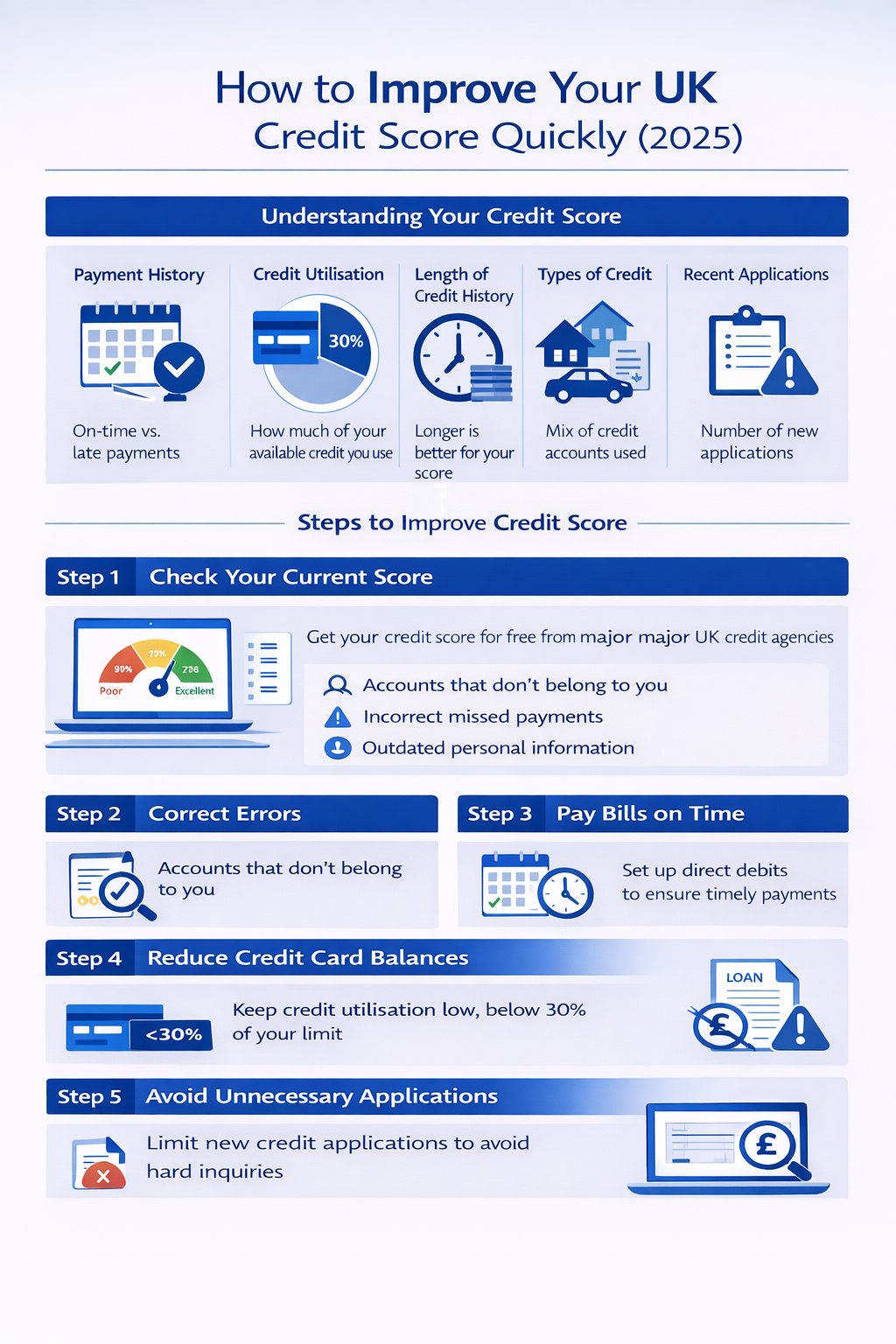

Visual summary of key points from 'How To Improve Your UK Credit Score Quickly'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

How to Improve Your UK Credit Score Quickly (2025)

Your credit score determines how easily you can access loans, mortgages, and even some rental agreements. Improving it doesn’t have to take years — with the right steps, you can see meaningful changes within a few months.

Understanding Your Credit Score

In the UK, your credit score ranges roughly between 300–850 (depending on the agency). Key factors affecting it include:

- Payment history (on-time vs late payments)

- Credit utilisation (how much of your available credit you use)

- Length of credit history

- Types of credit used (credit cards, loans, etc.)

- Recent applications for credit

Step 1: Check Your Current Score

Get a free report from agencies like Experian, Equifax, or TransUnion. Knowing your starting point helps you track improvement.

Step 2: Correct Errors

Check your credit report for mistakes. Common errors include:

- Accounts that don’t belong to you

- Incorrect missed payments

- Outdated personal information

Dispute errors immediately — correcting them can give a quick boost to your score.

Step 3: Pay Bills on Time

Timely payments are the single biggest factor. Consider:

- Setting up direct debits

- Automating reminders for monthly bills

- Prioritising debt repayments

Step 4: Reduce Credit Card Balances

Credit utilisation is a major factor. Keep balances below 30% of your available limit. Example:

- Credit limit: £5,000

- Current balance: £1,000 → Utilisation: 20%

Lower utilisation = better score.

Step 5: Avoid Unnecessary Applications

Each application for credit leaves a “hard inquiry” on your record. Multiple applications in a short period can hurt your score. Only apply when necessary.

Step 6: Build a Positive Credit History

Even small credit accounts, used responsibly, can help:

- Low-limit credit cards

- Store cards (used sensibly)

- Credit-builder loans

FAQs

How long does it take to improve my credit score?

Some changes, like correcting errors, can improve your score within weeks. Responsible habits improve your score steadily over months.

Will closing old credit accounts help?

Not usually. Length of credit history is important, so keeping old accounts open often benefits your score.

Can I boost my score with multiple cards?

Only if you manage them responsibly. Multiple cards with high balances can lower your score.

Next Steps

Check your current credit score today, fix any mistakes, and start using credit responsibly. Small consistent actions lead to meaningful improvements.