5 Low-Risk Investments UK Beginners Can Try | BudgetSense.co.uk

Visual summary of key points from '5 Low-Risk Investments UK Beginners Can Try | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

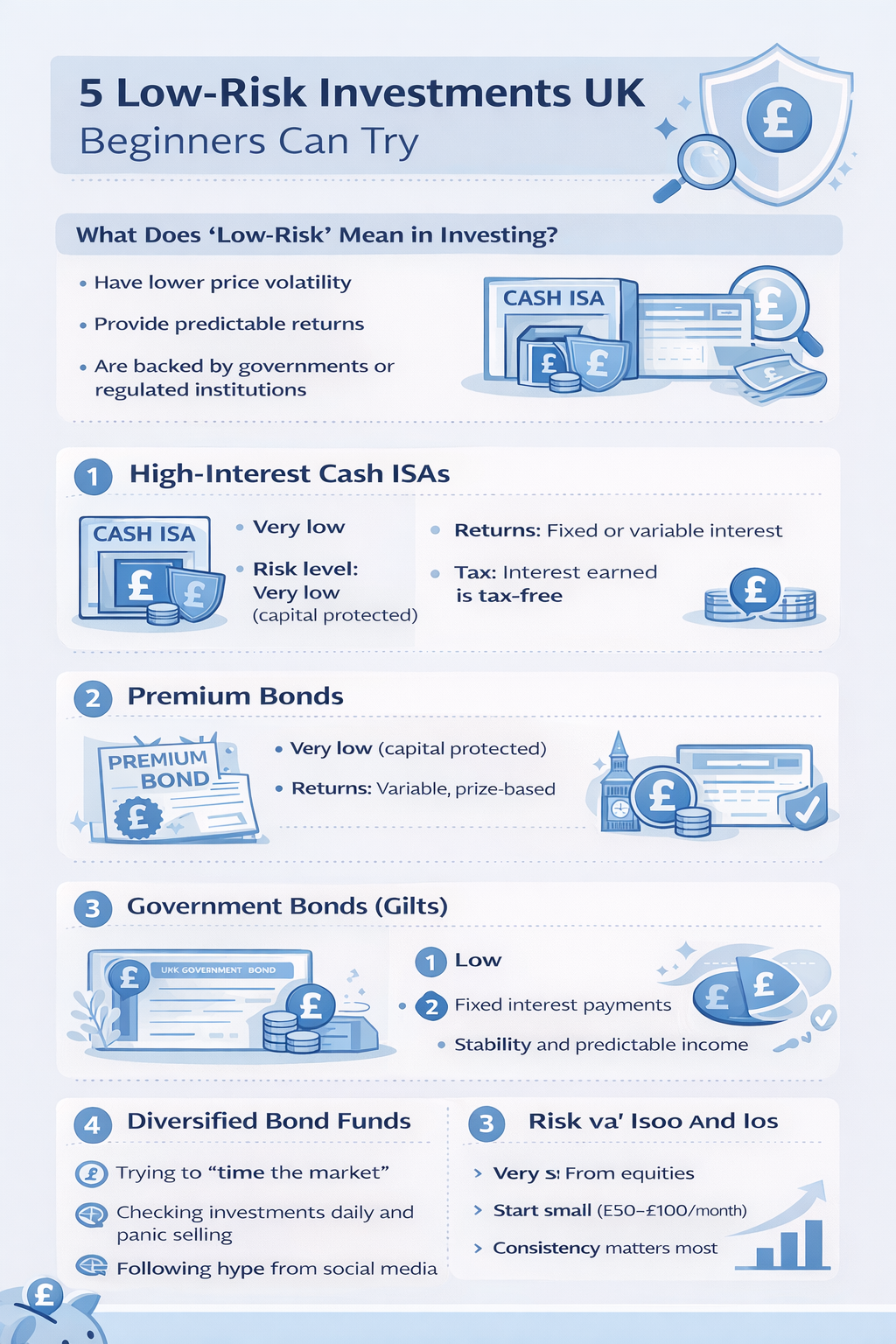

5 Low-Risk Investments UK Beginners Can Try

If you’re new to investing, searching for low-risk investments UK beginners can start with is completely sensible. While all investing carries some level of risk, there are options designed to protect your capital more than high-volatility UK stocks or speculative assets.

This guide explains five beginner-friendly, lower-risk investment options available in the UK — and how to decide which suits your goals.

What Does “Low-Risk” Mean in Investing?

Low-risk doesn’t mean no risk. Instead, it usually refers to investments that:

- Have lower price volatility

- Provide predictable returns

- Protect some or all of your original capital

- Are backed by governments or regulated institutions

Before investing, make sure you’ve cleared expensive debt. High-interest balances can wipe out any gains. If needed, read our guide on How to Pay Off Credit Card Debt Faster UK first.

1. High-Interest Cash ISAs

A Cash ISA is one of the safest starting points for low-risk investments UK beginners consider. While technically a savings product rather than a market investment, it protects your money from tax and keeps capital secure.

- Risk level: Very low

- Returns: Fixed or variable interest

- Tax: Interest earned is tax-free

Cash ISAs are ideal for short-term goals (1–3 years) or emergency funds.

2. Premium Bonds

Premium Bonds, issued by NS&I, are backed by the UK Government. Instead of earning interest, you’re entered into a monthly prize draw.

- Risk level: Very low (capital protected)

- Returns: Variable, prize-based

- Access: Easy withdrawal

You won’t lose your original deposit, making them popular among cautious savers.

3. Government Bonds (Gilts)

UK government bonds, known as gilts, are loans you make to the government in exchange for interest payments.

- Risk level: Low

- Returns: Fixed interest payments

- Best for: Stability and predictable income

Gilts can be bought directly or through bond funds and ETFs inside a Stocks and Shares ISA.

4. Diversified Bond Funds

Instead of buying individual bonds, beginners can invest in bond funds. These spread money across many government and corporate bonds.

- Risk level: Lower than equities

- Returns: Moderate, income-focused

- Benefit: Built-in diversification

Bond funds are often included in beginner portfolios to reduce volatility compared to pure UK stocks.

5. Global Index Funds (Conservative Allocation)

While equities carry more risk than savings accounts, broad global index funds are often considered relatively low-risk compared to picking individual UK stocks.

Instead of investing in one company, you spread your money across hundreds or thousands worldwide.

- Risk level: Moderate but diversified

- Returns: Historically higher long term

- Best for: Long-term growth (5+ years)

If you’re new to investing entirely, start with our full guide to Investing for Beginners UK to understand the basics before committing money.

How to Choose the Right Low-Risk Investment

When evaluating low-risk investments UK beginners can try, ask yourself:

- When will I need this money?

- Can I tolerate short-term fluctuations?

- Is capital protection more important than growth?

- Am I investing inside a tax-efficient account?

Short-term goals (under 3 years) usually favour Cash ISAs or Premium Bonds. Longer-term goals (5+ years) may justify diversified funds.

Common Mistakes to Avoid

- Assuming “low-risk” means guaranteed profits

- Investing emergency funds into volatile assets

- Ignoring inflation’s impact on cash savings

- Putting all money into one single product

Even cautious investors benefit from diversification and a long-term mindset.

Conclusion

Choosing low-risk investments UK beginners can try is about balancing safety and growth. From Cash ISAs and Premium Bonds to gilts and diversified funds, there are multiple ways to start building wealth without taking extreme risks.

Begin by reviewing your financial foundations, use tax-efficient accounts, and match your investment choice to your time horizon. For a complete roadmap, explore our Investing section on BudgetSense.co.uk and take your first confident step into investing today.