Best Student Savings App UK | BudgetSense.co.uk

Visual summary of key points from 'Best Student Savings App UK | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

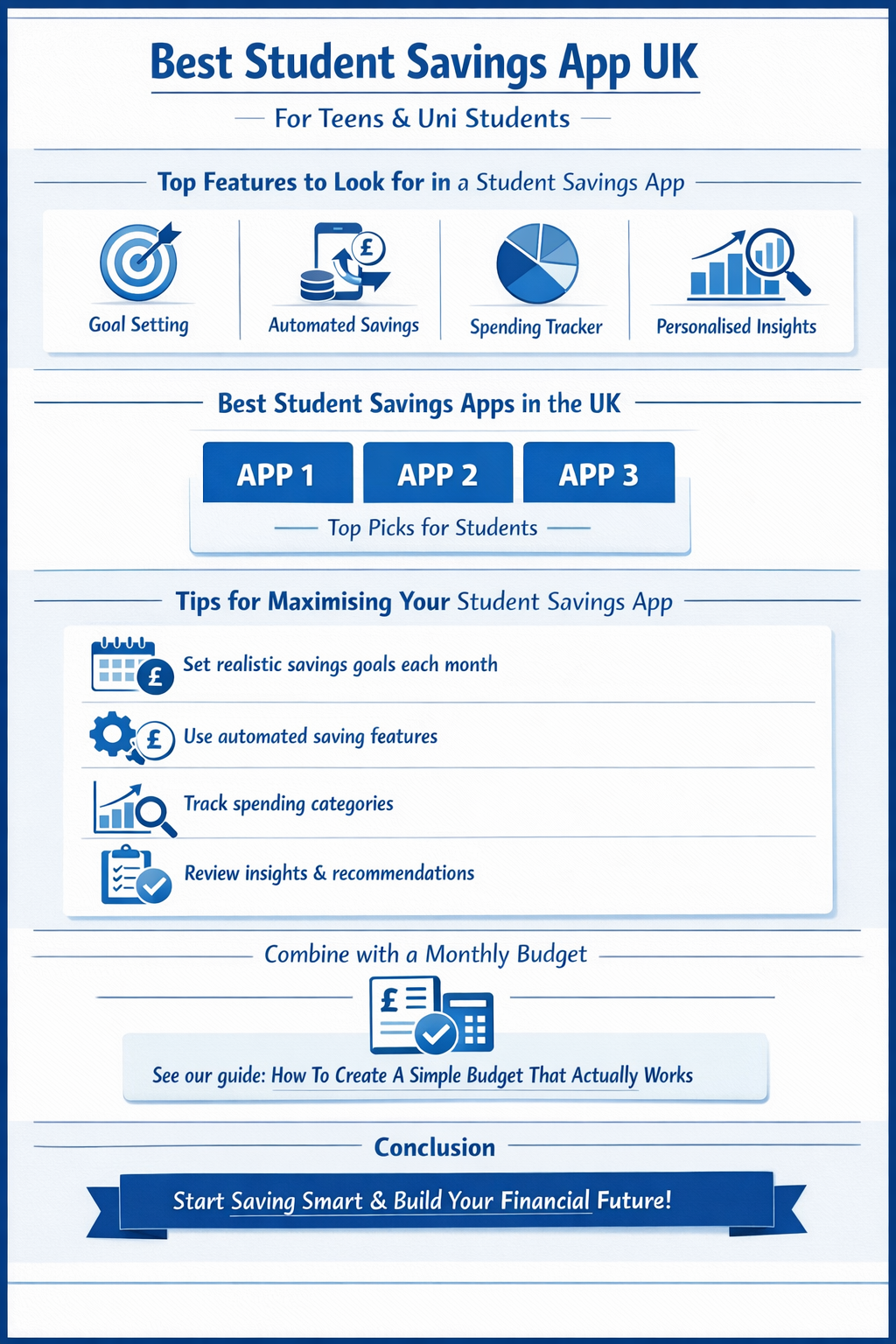

Best Student Savings App UK for Teens & Uni Students

Finding the right student savings app UK can make a real difference for teens and university students trying to manage their money. With student life often bringing tight budgets, unpredictable expenses, and the need for financial independence, having a reliable app to track and grow your savings is essential. In this guide, we’ll explore the best student savings apps in the UK, how they can help you save smarter, and the features you should look for in a save money app UK or student finance app.

Top Features to Look for in a Student Savings App

When choosing a student savings app UK, it’s important to consider features that match your lifestyle and goals. Here are the key aspects:

Ease of Use

A good student finance app should be simple to navigate. Apps that offer a clean interface, easy setup, and quick access to account information save time and reduce stress. Look for apps that allow you to link your bank account, track spending, and manage savings without complicated menus.

Automated Saving Tools

Many save money app UK options include automation features. These can round up your purchases to the nearest pound and transfer the spare change into a savings account. Others allow scheduled weekly or monthly transfers, helping you save consistently without thinking about it. For more tips on consistent saving, check out our guide on How to Save Money Consistently on a UK Budget.

Budget Tracking

Keeping an eye on your spending is crucial as a student. Apps that provide budgeting tools, spending categorisation, and alerts for overspending can help you stay within your limits. Some student finance apps even suggest ways to reduce unnecessary expenses, helping you achieve your saving goals faster.

Best Student Savings Apps in the UK

Plum

Plum is a smart saving app that links to your bank account and uses AI to analyse your spending, automatically putting money aside for you. It’s particularly good for students who want a hands-off approach. Plum also offers investment options for those interested in growing their savings beyond a standard account.

Yolt

Yolt is more than just a savings app; it’s a personal finance app that allows you to track all your accounts in one place. With budgeting tools, spending insights, and saving challenges, Yolt helps students manage money smartly. Its “Goals” feature allows you to save for specific targets like books or a holiday.

Chip

Chip is another popular student finance app in the UK. It automatically analyses your income and spending to transfer small amounts into savings regularly. Chip also provides notifications and suggestions to help you optimise your saving habits. The app is perfect for students wanting an effortless way to build a financial cushion.

Squirrel

Squirrel combines saving with bill management. It allows you to receive your student loan in instalments, automatically pay bills, and save the remainder. This app is excellent for students who struggle with budgeting irregular income, providing both control and peace of mind.

Tips for Maximising Your Student Savings App

- Set realistic savings goals each month.

- Use automated saving features for consistency.

- Track spending categories to identify where you can cut back.

- Review app recommendations and personalised insights regularly.

- Combine your app strategy with a monthly budget using our How To Create A Simple Budget That Actually Works.

Conclusion

Choosing the right student savings app UK can transform the way teens and university students manage their finances. By selecting an app that fits your lifestyle, automates savings, and helps track spending, you can take control of your money, save smarter, and build a foundation for financial independence.

Start today by exploring the apps listed above and see which one works best for you. For a full guide to staying on top of your finances, don’t forget to check our other resources on How to Save Money Consistently on a UK Budget and How To Create A Simple Budget That Actually Works. Take control of your money and start saving smarter today!