50 Easy Ways To Save 100 A Month | BudgetSense.co.uk

Visual summary of key points from '50 Easy Ways To Save 100 A Month | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

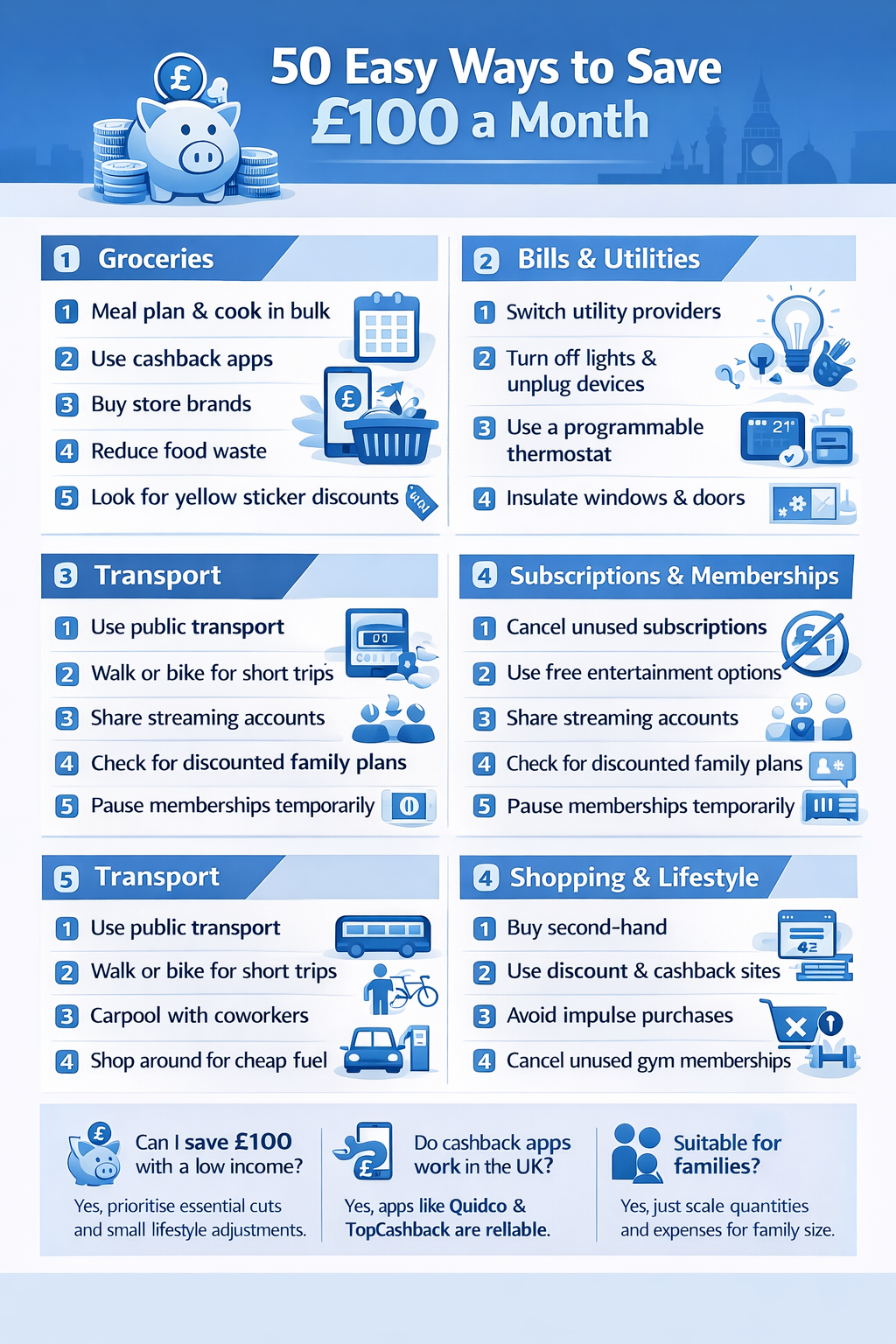

50 Easy Ways to Save £100 a Month

Saving money doesn’t have to be hard. With small, consistent changes, UK households can easily save £100 a month or more. Here’s a practical guide with 50 ideas across multiple categories.

Groceries

| # | Action | Estimated Savings |

|---|---|---|

| 1 | Switch to own-brand products | £20–£40 |

| 2 | Buy in bulk for frequently used items | £5–£15 |

| 3 | Plan weekly meals to avoid impulse buys | £10–£20 |

| 4 | Use supermarket loyalty cards for discounts | £5–£10 |

| 5 | Shop offers and coupons carefully | £5–£15 |

| 6 | Reduce takeaways and ready meals | £15–£25 |

| 7 | Freeze leftovers to prevent waste | £5–£10 |

| 8 | Buy seasonal produce | £5–£15 |

| 9 | Compare prices using apps like MySupermarket or Trolley.co.uk | £5–£10 |

| 10 | Reduce meat consumption (meat-free meals) | £10–£20 |

Bills & Utilities

| # | Action | Estimated Savings |

|---|---|---|

| 11 | Switch energy provider to a better tariff | £15–£30 |

| 12 | Install energy-saving bulbs and appliances | £5–£10 |

| 13 | Turn off standby devices | £5–£10 |

| 14 | Reduce heating slightly in winter | £10–£20 |

| 15 | Check water meter and reduce wastage | £5–£15 |

| 16 | Bundle internet, TV, and phone services | £5–£15 |

| 17 | Negotiate broadband and phone contracts annually | £10–£20 |

| 18 | Use smart thermostats for efficient heating | £5–£15 |

| 19 | Claim back overpaid council tax if eligible | £5–£25 |

| 20 | Switch insurance policies annually | £10–£30 |

Subscriptions & Memberships

| # | Action | Estimated Savings |

|---|---|---|

| 21 | Cancel unused streaming services | £5–£15 |

| 22 | Review magazine and newspaper subscriptions | £5–£10 |

| 23 | Switch gym membership to pay-as-you-go or home workouts | £10–£25 |

| 24 | Use free online courses instead of paid ones | £5–£15 |

| 25 | Audit app subscriptions on phones | £5–£10 |

| 26 | Share streaming accounts with family/friends legally | £5–£15 |

| 27 | Opt for free versions of apps | £5–£10 |

| 28 | Cancel unused club memberships | £5–£20 |

| 29 | Bundle entertainment with broadband deals | £5–£15 |

| 30 | Check for student, senior, or loyalty discounts | £5–£10 |

Transport

| # | Action | Estimated Savings |

|---|---|---|

| 31 | Use public transport instead of driving | £10–£30 |

| 32 | Walk or cycle short distances | £5–£15 |

| 33 | Carpool or share journeys with colleagues | £5–£20 |

| 34 | Plan fuel purchases at cheaper stations | £5–£15 |

| 35 | Maintain car for fuel efficiency | £5–£15 |

| 36 | Switch to cheaper insurance for low-mileage drivers | £10–£25 |

| 37 | Buy railcards (16-25, Two Together, Senior) | £5–£20 |

| 38 | Use contactless payment caps for transport | £5–£10 |

| 39 | Consider second-hand bicycles or scooters | £5–£15 |

| 40 | Plan journeys to combine trips and save fuel | £5–£10 |

Shopping & Lifestyle

| # | Action | Estimated Savings |

|---|---|---|

| 41 | Buy second-hand clothes and items online | £5–£20 |

| 42 | Use cashback apps like Quidco or TopCashback | £5–£15 |

| 43 | Wait for sales and discount codes | £5–£15 |

| 44 | Repair instead of replacing household items | £5–£20 |

| 45 | Use reusable items (bottles, bags, containers) | £5–£10 |

| 46 | Reduce alcohol and coffee purchases outside | £10–£20 |

| 47 | DIY small home projects instead of hiring | £5–£20 |

| 48 | Compare prices online before purchases | £5–£15 |

| 49 | Set a monthly spending limit on non-essential items | £5–£15 |

| 50 | Use loyalty points or reward schemes | £5–£10 |

Summary

By combining just a few of these 50 actions, you can easily save £100 per month. Track your progress, adjust where needed, and over time these savings can compound into hundreds or thousands annually.

FAQs

- Can I save £100 a month with a low income? → Yes, by prioritising essential cuts and small lifestyle adjustments.

- Do cashback apps really work in the UK? → Yes, apps like Quidco and TopCashback are reliable.

- Should I track every penny? → Tracking helps, but focus on high-impact areas first.

- Are these tips suitable for families? → Yes, just scale quantities and expenses according to family size.

- Do small savings really add up? → Yes, consistent small savings can reach £1,000+ per year.