Track Daily Expenses UK Freelancers | BudgetSense.co.uk

Visual summary of key points from 'Track Daily Expenses UK Freelancers | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

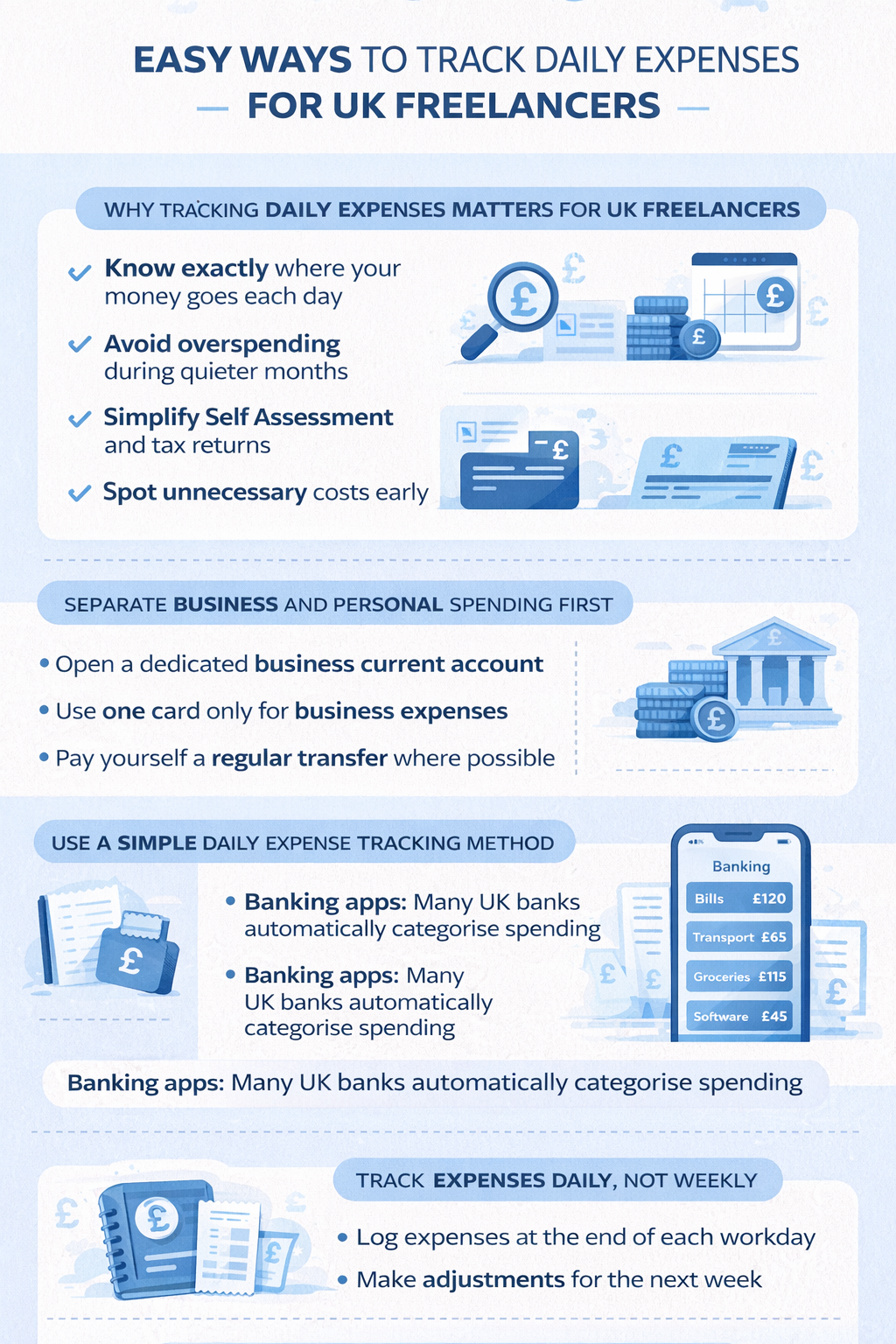

Easy Ways to Track Daily Expenses for UK Freelancers

Learning how to track expenses UK freelancers face on a daily basis is one of the most important financial habits you can build. When your income changes month to month and business and personal spending often overlap, it’s easy to lose control. A simple daily expense tracking system gives you clarity, reduces tax stress, and helps you keep more of what you earn.

Why Tracking Daily Expenses Matters for UK Freelancers

Freelancers don’t have the luxury of predictable payslips. That’s why freelancers money tracking needs to be more disciplined than traditional budgeting.

When you track expenses UK-wide consistently, you:

- Know exactly where your money goes each day

- Avoid overspending during quieter months

- Simplify Self Assessment and tax returns

- Spot unnecessary costs early

Small daily purchases — coffees, subscriptions, travel — are often the biggest leak in a freelancer’s finances.

Separate Business and Personal Spending First

Before choosing a system, make expense tracking easier by separating finances.

- Open a dedicated business current account

- Use one card only for business expenses

- Pay yourself a regular transfer where possible

This instantly improves your daily expense tracker UK accuracy and prevents missed deductions. It also makes monthly reviews far less time-consuming.

Use a Simple Daily Expense Tracking Method

You don’t need complicated software to track expenses UK freelancers deal with. What matters is consistency.

Choose one of these daily tracking options:

- Banking apps: Many UK banks automatically categorise spending

- Budgeting apps: Great for automation and reporting

- Spreadsheet: Simple, flexible, and free

- Notes app: Quick manual entry at the point of purchase

If you want automation, explore the best budgeting apps UK with interest tracking to reduce admin time.

Track Expenses Daily, Not Weekly

One of the biggest mistakes freelancers make is delaying updates. Daily tracking takes less than five minutes and keeps spending visible.

Make it part of your routine:

- Log expenses at the end of each workday

- Save digital receipts immediately

- Add notes explaining business purpose

This habit dramatically improves freelancers money tracking accuracy and prevents end-of-month overwhelm.

What Expenses Should UK Freelancers Track?

Track everything, even if you’re unsure whether it’s allowable. Common categories include:

- Home office costs and utilities

- Software subscriptions and tools

- Travel, fuel, and public transport

- Meals and client entertainment

- Professional fees and insurance

You can review eligibility later, but logging all spending keeps your records complete.

Review Your Daily Expenses Weekly

Daily logging is powerful, but weekly reviews are where insight happens.

Once a week:

- Check category totals

- Identify overspending patterns

- Plan adjustments for the next week

This process links naturally into a wider budgeting system. If you haven’t already, follow our Step-by-Step Guide to Making a Monthly Budget Plan UK to turn expense tracking into long-term control.

Common Expense Tracking Mistakes Freelancers Make

- Only tracking “big” expenses

- Mixing personal and business spending

- Relying on memory instead of records

- Not reviewing spending regularly

Tracking isn’t about perfection — it’s about awareness.

How Daily Expense Tracking Improves Financial Stability

When you track expenses UK freelancers face daily, budgeting becomes easier, savings feel achievable, and tax bills stop being a shock.

Over time, you’ll:

- Build stronger cash flow buffers

- Set realistic income targets

- Reduce financial stress

- Make confident business decisions

Conclusion

Building a simple system to track expenses UK freelancers deal with every day is one of the fastest ways to regain financial control. You don’t need perfection — just consistency. Start today with one method, log expenses daily, and review weekly.

Next step: Choose your tracking tool, log today’s spending, and connect it to a monthly plan using our budgeting guides. Small habits now create long-term financial freedom.