Save Money Consistently UK Budget Guide | BudgetSense.co.uk

Visual summary of key points from 'Save Money Consistently UK Budget Guide | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

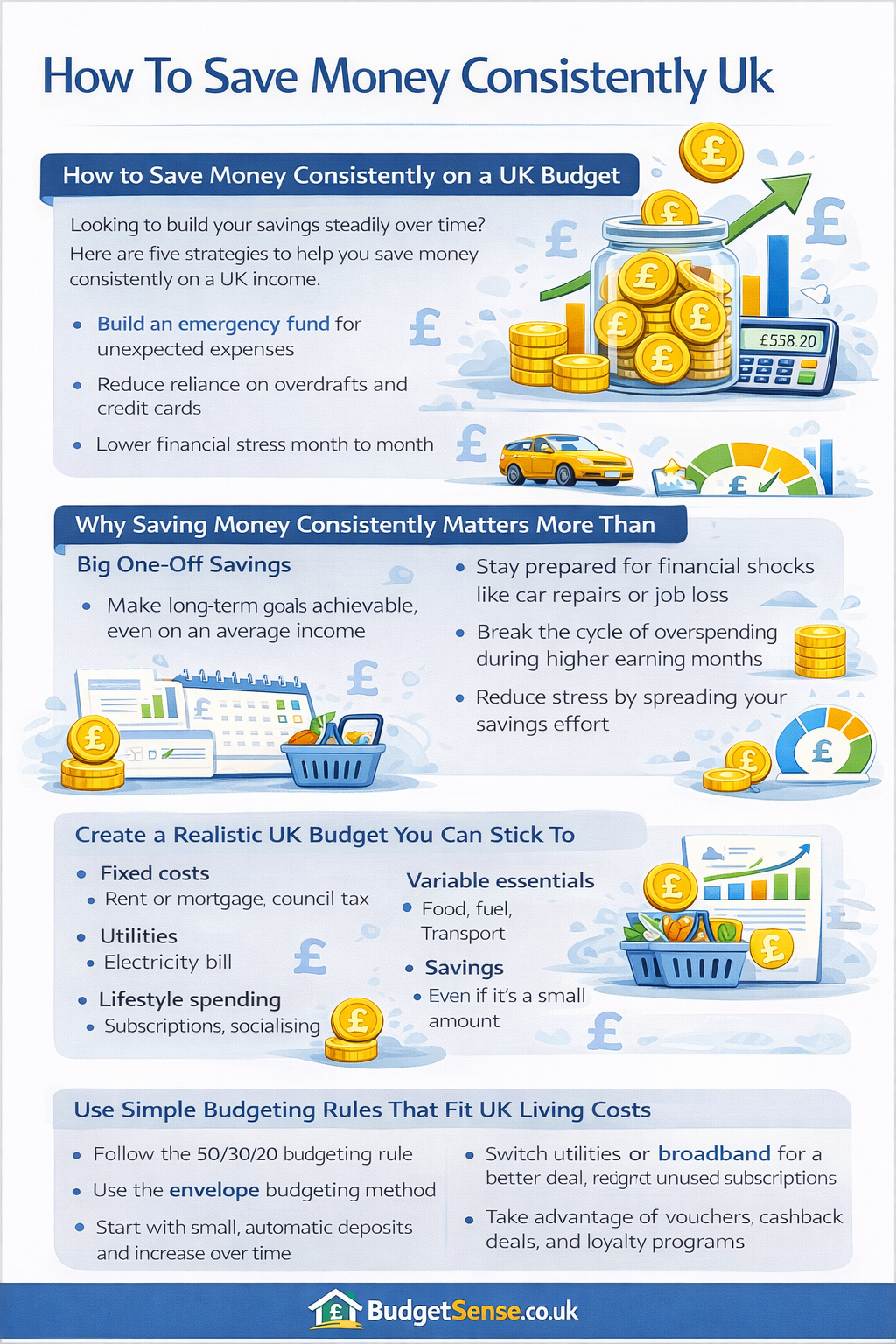

How to Save Money Consistently on a UK Budget

Learning how to save money consistently can feel impossible when you’re living on a tight UK budget. With rising food costs, higher energy bills, and everyday expenses creeping up, many people feel there’s nothing left to save at the end of the month. The good news is that saving consistently isn’t about cutting out everything you enjoy — it’s about building simple habits that actually work in real life.

This guide explains practical, realistic ways to save money consistently in the UK. Whether you’re starting from scratch or trying to stay on track, these budgeting tips are designed to be sustainable, stress-free, and effective over the long term.

Why Saving Money Consistently Matters More Than Big One-Off Savings

One of the biggest misconceptions about saving is that it only counts if you’re putting away large amounts. In reality, consistency matters far more than size. Saving small amounts regularly is far easier to maintain on a UK budget.

For example, saving £20 per week adds up to over £1,000 per year. That’s without needing a pay rise or drastic lifestyle changes.

Saving money consistently helps you:

- Build an emergency fund for unexpected expenses

- Reduce reliance on overdrafts and credit cards

- Lower financial stress month to month

- Make long-term goals achievable, even on an average income

The goal is to make saving automatic and predictable, not something you only do when money feels “spare”.

Create a Realistic UK Budget You Can Stick To

If you want to save money consistently, your budget needs to reflect real life — not a perfect version of it. A realistic UK budget includes essentials, flexibility, and savings built in from the start.

A simple budget should cover:

- Fixed costs (rent or mortgage, council tax, utilities)

- Variable essentials (food, fuel, transport)

- Lifestyle spending (subscriptions, socialising)

- Savings (even if it’s a small amount)

If you’re unsure where your money goes each month, start by tracking it. Guides like 5 Simple Ways to Track Your Expenses can help you spot spending leaks quickly without turning budgeting into a chore.

Don’t try to cut everything at once. Awareness comes first — consistent saving follows naturally once you understand your spending patterns.

Automate Your Savings to Stay Consistent

One of the easiest ways to save money consistently is automation. By removing willpower from the process, you make saving happen before spending gets a chance.

Popular automation options in the UK include:

- Standing orders to savings accounts on payday

- Round-up features in banking apps

- Separate savings pots for specific goals

Many modern tools make this even easier. Reviews such as Best Budgeting Apps UK with Interest Tracking highlight apps that automate savings while still letting you see progress clearly.

Even saving £10–£25 per month is enough to build momentum. The habit matters more than the amount.

Use Simple Budgeting Rules That Fit UK Living Costs

Frameworks like the 50/30/20 rule can work well on a UK budget — as long as they’re adapted realistically.

- Needs (around 50%): Housing, utilities, food, transport

- Wants (around 30%): Entertainment, eating out, subscriptions

- Savings (around 20%): Emergency fund and goals

For many UK households, housing costs exceed 50%. That’s normal. The key principle is protecting some level of savings, even if it starts at 5–10%.

Saving money consistently at a smaller rate is far better than giving up because a target feels unrealistic.

Cut Costs That Don’t Affect Your Quality of Life

The most effective budgeting tips focus on cutting spending you don’t value, not removing everything enjoyable from your life.

Common UK money leaks include:

- Unused or forgotten subscriptions

- Insurance policies not switched at renewal

- Expensive mobile or broadband contracts

- Energy tariffs that haven’t been reviewed

Redirect any savings straight into your savings account. This creates “invisible savings” — money you won’t miss but will benefit from long term.

Use Sinking Funds to Protect Your Savings

One of the biggest reasons people fail to save money consistently is unexpected expenses. Sinking funds solve this by spreading predictable costs across the year.

Common UK sinking funds include:

- Car maintenance and MOTs

- Christmas and birthdays

- Annual insurance payments

- School-related costs

Saving a small amount monthly into separate pots prevents these costs from wiping out your progress.

Make Your Savings Visible and Motivating

Consistency improves when you can see progress. Make saving feel rewarding, not restrictive.

Helpful ideas include:

- Naming savings pots with clear goals

- Tracking milestones (£100, £500, £1,000)

- Reviewing savings monthly instead of daily

Avoid checking balances constantly. Monthly reviews help you stay motivated without triggering unnecessary spending.

Summary: Consistency Beats Perfection

Saving money consistently on a UK budget is achievable for almost everyone — even when money feels tight. By using realistic budgets, automating savings, cutting low-impact costs, and planning for irregular expenses, you can build a system that works month after month.

You don’t need to save large amounts to succeed. Small actions, repeated consistently, lead to real financial security.

Next step: Choose one change today — automate a small saving, review a subscription, or track spending for a week. Consistency is what turns effort into results.