Ultimate Guide To Budgeting UK | BudgetSense.co.uk

Visual summary of key points from 'Ultimate Guide To Budgeting UK | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

The Ultimate Guide to Budgeting in the UK (2025)

Budgeting doesn’t have to feel restrictive or complicated. With rising costs and uncertainty, having a clear, practical plan for your money is essential. This guide walks you through everything you need to create a budget that works in real life, tailored for the UK.

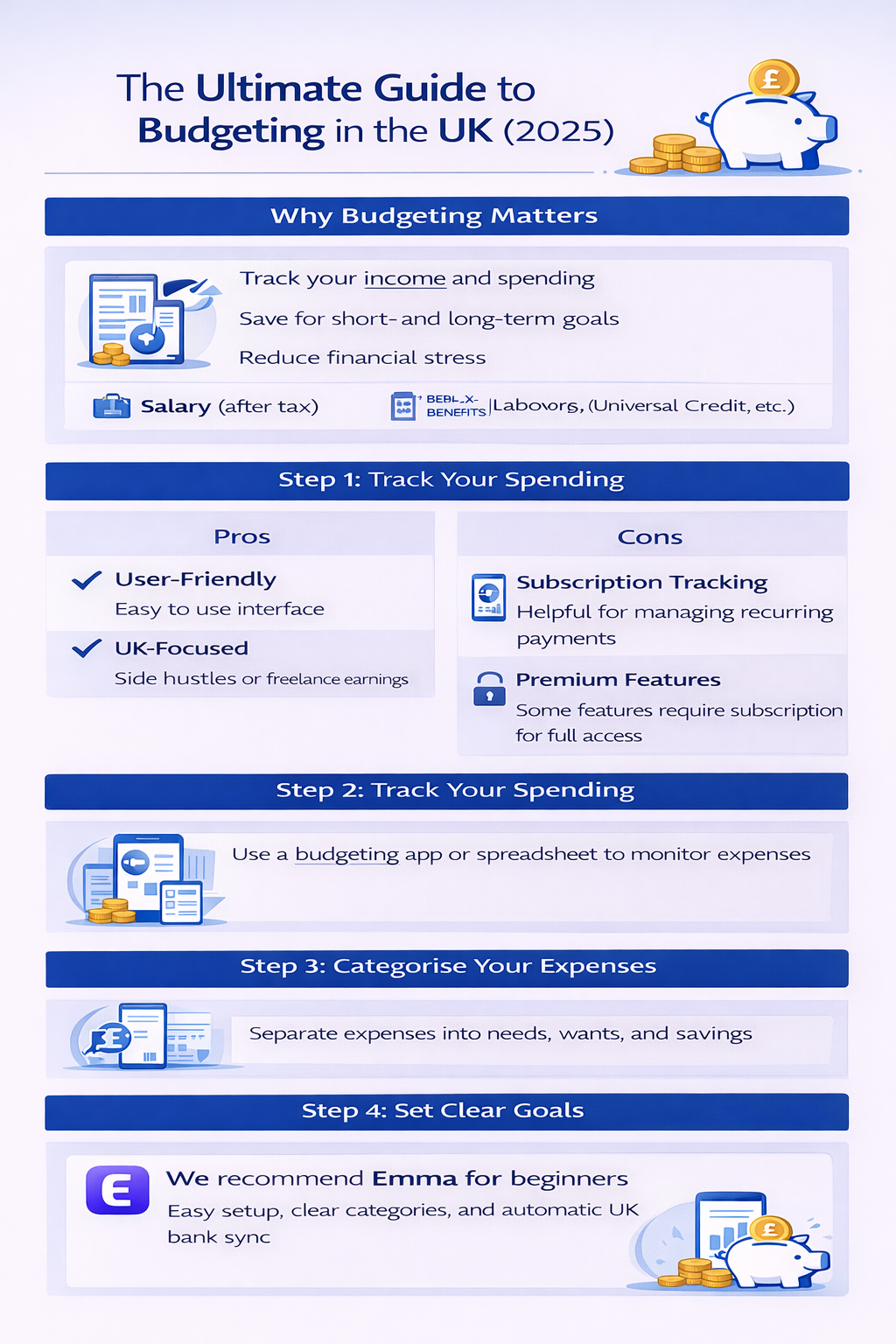

Why Budgeting Matters

A budget helps you:

- Track your income and spending

- Save for short- and long-term goals

- Reduce financial stress

- Plan for emergencies and unexpected costs

Even small improvements in how you manage money can add up to significant financial freedom over time.

Step 1: Understand Your Income

Start by calculating your total monthly income. Include:

- Salary (after tax)

- Any government benefits (Child Benefit, Universal Credit, etc.)

- Side hustles or freelance earnings

Knowing your exact income is the foundation of any budget. It prevents overspending and gives clarity on what you can realistically save each month.

Step 2: Track Your Spending

For one month, record every expense:

- Rent or mortgage

- Utilities (electricity, gas, water)

- Transport (public transit, fuel)

- Groceries and eating out

- Subscriptions and hobbies

Apps like Emma or YNAB can help track spending automatically. Even a simple spreadsheet works if you prefer manual tracking.

Step 3: Categorise Your Expenses

Divide spending into three main buckets:

| Category | What it Covers | Suggested % of Income |

|---|---|---|

| Essentials | Rent/mortgage, bills, groceries, transport | 50–60% |

| Lifestyle | Eating out, entertainment, hobbies | 20–30% |

| Savings & Future | Savings, investments, debt repayment | 10–20% |

Adjust percentages to suit your personal situation. The goal is balance, not perfection.

Step 4: Set Clear Goals

Define your short-term and long-term goals:

- Short-term: £500 emergency fund, holiday fund, paying off credit card debt

- Long-term: house deposit, retirement savings, investment portfolio

Having concrete targets motivates you and helps prioritise spending.

Step 5: Automate Savings

Where possible, automate your savings:

- Set up a separate savings account

- Schedule monthly transfers from your main account

- Automate pension contributions

Automation removes the temptation to spend and ensures you consistently save.

Step 6: Review and Adjust Monthly

Each month, review your spending and savings:

- Compare actual spending to your budget

- Adjust categories if necessary

- Reward yourself for progress

Budgets should be flexible. Life changes, and your budget should adapt without causing stress.

Common Mistakes to Avoid

- Ignoring small, frequent purchases – they add up!

- Setting unrealistic limits – your budget must be sustainable

- Not updating regularly – outdated budgets are useless

- Failing to plan for emergencies – unexpected costs will derail your budget

FAQs

Do I need a strict budget to succeed?

No. A flexible, realistic budget is more effective than a rigid plan that’s hard to follow.

Can I budget if I’m self-employed?

Yes. Focus on variable income, track business expenses separately, and plan for tax payments.

How much should I save each month?

Aim for at least 10% of your income. Increase over time as your situation allows.

Next Steps

Start today: record your income, track your expenses, and create your first three-month budget. Consistency is key.