Monthly Budget Plan UK Guide | BudgetSense.co.uk

Visual summary of key points from 'Monthly Budget Plan UK Guide | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

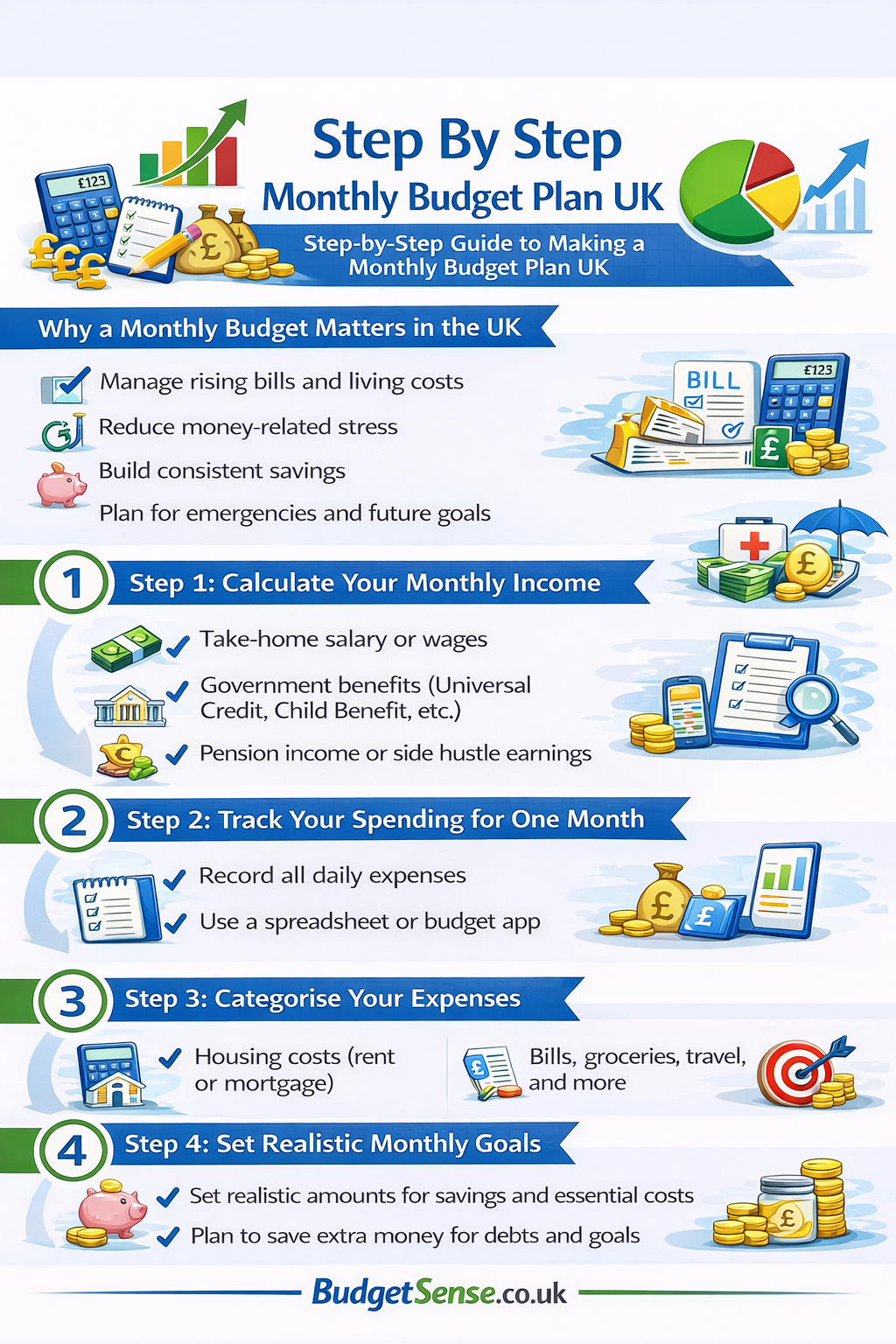

Step-by-Step Guide to Making a Monthly Budget Plan UK

Creating a monthly budget UK style doesn’t need to be complicated or restrictive. With rising household costs and unpredictable expenses, having a clear monthly budget plan is one of the most effective ways to take control of your finances. This step-by-step guide shows you exactly how to build a realistic budget plan UK households can actually stick to.

Why a Monthly Budget Matters in the UK

A monthly budget gives you visibility and control over your money. Instead of wondering where your income goes each month, you make intentional decisions about spending, saving, and planning ahead.

A solid monthly budget UK approach helps you:

- Manage rising bills and living costs

- Reduce money-related stress

- Build consistent savings

- Plan for emergencies and future goals

This is the foundation of good UK money management, regardless of your income level.

Step 1: Calculate Your Monthly Income

Start by working out your total monthly income after tax. Be honest and accurate.

- Take-home salary or wages

- Government benefits (Universal Credit, Child Benefit, etc.)

- Pension income or side hustle earnings

If your income varies, calculate an average over the last three to six months. This creates a realistic baseline for your monthly budget UK.

Step 2: Track Your Spending for One Month

Before creating your budget plan UK style, you need to know where your money currently goes. Track every expense for a full month.

- Housing costs (rent or mortgage)

- Household bills and utilities

- Food and groceries

- Transport and travel

- Subscriptions and discretionary spending

You can use a spreadsheet, banking app, or one of the best budgeting apps UK with interest tracking to automate this process.

Step 3: Categorise Your Expenses

Once you’ve tracked spending, group expenses into clear categories. This makes your monthly budget easier to manage and adjust.

| Category | Examples | Typical % |

|---|---|---|

| Essentials | Housing, bills, groceries, transport | 50–60% |

| Lifestyle | Eating out, hobbies, entertainment | 20–30% |

| Savings & Debt | Savings, investments, repayments | 10–20% |

These percentages are guidelines, not rules. Adjust your budget plan UK structure based on your situation.

Step 4: Set Realistic Monthly Goals

Without goals, a monthly budget feels pointless. Decide what you want your money to achieve.

- Short-term: emergency fund, holiday savings, paying off credit cards

- Medium-term: car replacement, home improvements

- Long-term: house deposit, retirement planning

If saving feels difficult, read our guide on 50 Easy Ways To Save £100 A Month to build momentum.

Step 5: Automate Your Monthly Budget

Automation is one of the most powerful tools in UK money management. It removes willpower from the equation.

- Set standing orders to savings accounts

- Automate bill payments

- Increase pension contributions automatically

When savings happen first, you’re far more likely to stick to your monthly budget UK after month.

Step 6: Review and Adjust Every Month

No budget plan UK households create is perfect on the first try. Review your budget monthly.

- Check where you overspent or underspent

- Adjust categories to reflect real life

- Plan ahead for upcoming expenses

Your budget should support your life — not punish you.

Common Monthly Budget Mistakes to Avoid

- Forgetting annual or irregular expenses

- Being too strict and giving up

- Not tracking spending consistently

- Ignoring small daily purchases

Awareness is more important than perfection.

FAQs

How much should I save in my monthly budget UK?

Aim for at least 10% of your income if possible. Start smaller if needed and increase gradually.

Can I create a monthly budget if my income changes?

Yes. Base your budget on your lowest reliable income and treat extra earnings as bonuses.

Do budgeting apps really help?

They can. Many UK budgeting apps track spending, interest, and savings automatically, reducing effort.

Next Steps

Your monthly budget UK journey starts now. Write down your income, track your spending this month, and build your first realistic budget plan. Small, consistent actions today create long-term financial stability.