Switch UK Energy Providers & Save | BudgetSense.co.uk

Visual summary of key points from 'Switch UK Energy Providers & Save | BudgetSense.co.uk'

Essential UK Budgeting & Personal Finance Guides for 2025

Discover practical tips, tools, and strategies to manage your money, save effectively, and stay on top of your finances.

Check out our key articles: How to Create a Simple Budget, How to Save £500 in 3 Months, Understanding Credit Scores in the UK.

How to Switch UK Energy Providers & Save Money

Knowing how to switch energy provider UK households rely on is one of the simplest ways to cut monthly bills. With energy prices still volatile, regularly comparing tariffs can save hundreds of pounds a year without reducing comfort or usage.

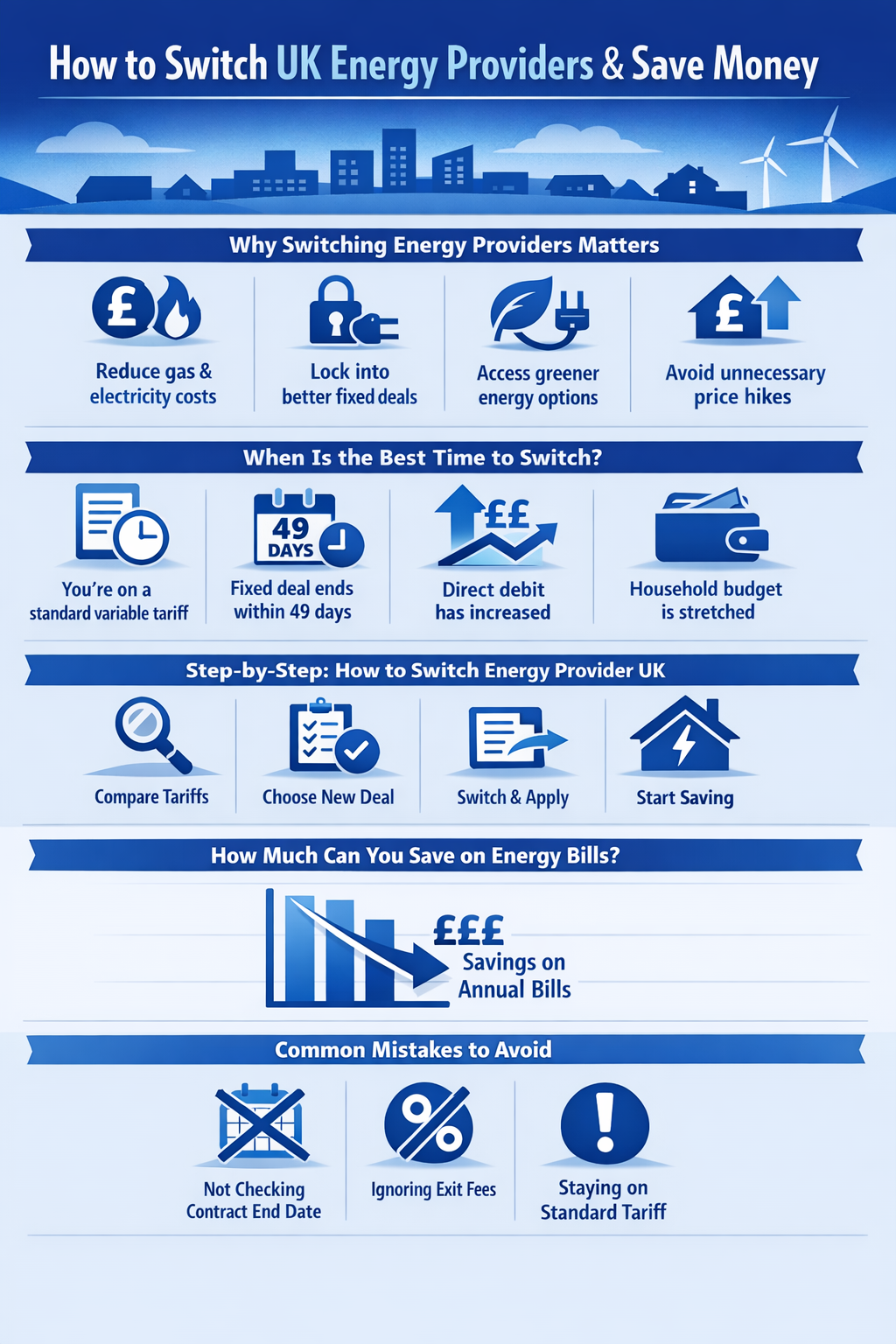

Why Switching Energy Providers Matters

Many UK households stay on expensive standard variable tariffs without realising it. By switching, you can:

- Reduce gas and electricity costs

- Lock into better fixed deals when available

- Access greener energy options

- Avoid unnecessary price hikes

Switching energy provider UK-wide is now easier than ever and usually takes less than 10 minutes online.

When Is the Best Time to Switch?

You can switch energy providers at almost any time, but it’s especially worth checking if:

- You’re on a standard variable tariff

- Your fixed deal is ending within the next 49 days

- Your monthly direct debit has increased

- Your household budget feels stretched

Switching within the last 49 days of a fixed tariff won’t usually incur exit fees, making this the ideal window to compare deals.

Step-by-Step: How to Switch Energy Provider UK

1. Gather Your Details

Before comparing, have the following ready:

- Your postcode

- Current supplier and tariff name

- Estimated annual usage (from your bill)

2. Use an Energy Comparison Site

Energy comparison UK websites allow you to see multiple deals side by side. Focus on total annual cost, not just monthly payments.

This is a great moment to review other household costs too. Pair this with strategies from Top 10 Ways to Reduce Household Bills in the UK to maximise savings.

3. Choose the Right Tariff

Consider whether a fixed or variable tariff suits you best:

- Fixed: Price stability for budgeting

- Variable: Flexibility, but prices can rise

Green tariffs may cost slightly more, but many are now competitively priced and reduce your carbon footprint.

4. Switch Online

Once you’ve chosen a deal, the new supplier handles the switch. There’s no interruption to your supply and no engineer visit needed.

How Much Can You Save on Energy Bills?

Typical savings from switching energy provider UK households report range from £150 to £400 per year, depending on usage and tariff type.

To increase savings further:

- Review direct debit amounts annually

- Submit meter readings regularly

- Reduce overall energy usage

Cutting food costs can also free up cash to offset bills — see Reduce Grocery Spend UK for practical ideas.

Common Mistakes to Avoid

- Only comparing monthly prices instead of annual cost

- Ignoring exit fees on fixed tariffs

- Assuming loyalty equals better deals

- Forgetting to check standing charges

A quick annual review can prevent overpaying year after year.

FAQs About Switching Energy Providers

Will my energy supply be interrupted?

No. Switching suppliers does not affect your gas or electricity supply.

Does switching affect my credit score?

No. Energy checks are soft searches and do not impact your credit rating.

How long does a switch take?

The process usually completes within 5–21 days, depending on the tariff.

Conclusion: Start Saving Today

Learning how to switch energy provider UK households depend on is a powerful step towards lowering bills and improving financial stability. By comparing deals annually and reviewing usage, you can stay in control of rising costs.

Take action today: compare tariffs, switch if you can, and redirect the savings towards your wider financial goals.